Hudson at Georgia’s Landing

Hudson at Georgia’s Landing

Hudson at Georgia’s Landing 6

Hudson at Georgia’s Landing 1

Hudson at Georgia’s Landing 3

Hudson at Georgia’s Landing 7

Hudson at Georgia’s Landing 2

Hudson at Georgia’s Landing 5

Hudson at Georgia’s Landing 4

Executive Summary

Hudson at Georgia’s Landing will be a two phase, build-to-rent (BTR) development that will be a part of a larger master-planned community, Georgia's Landing, in Garner, NC. This offering will be the first phase and includes the development of 138 units out of 259 total. The shovel-ready development will be a qualified Opportunity Zone project located a few minutes south of Downtown Raleigh and will offer new, high-quality units within a fully-amenitized master-planned community to residents looking for a suburban lifestyle without sacrificing superior access to employment and entertainment nodes throughout the metro.

The Hudson at Georgia’s Landing offering is the first phase of a two-phase development project that will be part of a larger 238-unit master-planned community. The first phase includes the development of 138 units in 28 buildings The majority of the residences — 100 units — will be two and three stories and enjoy the community’s luxury amenities.Construction is expected to be completed in 2024.

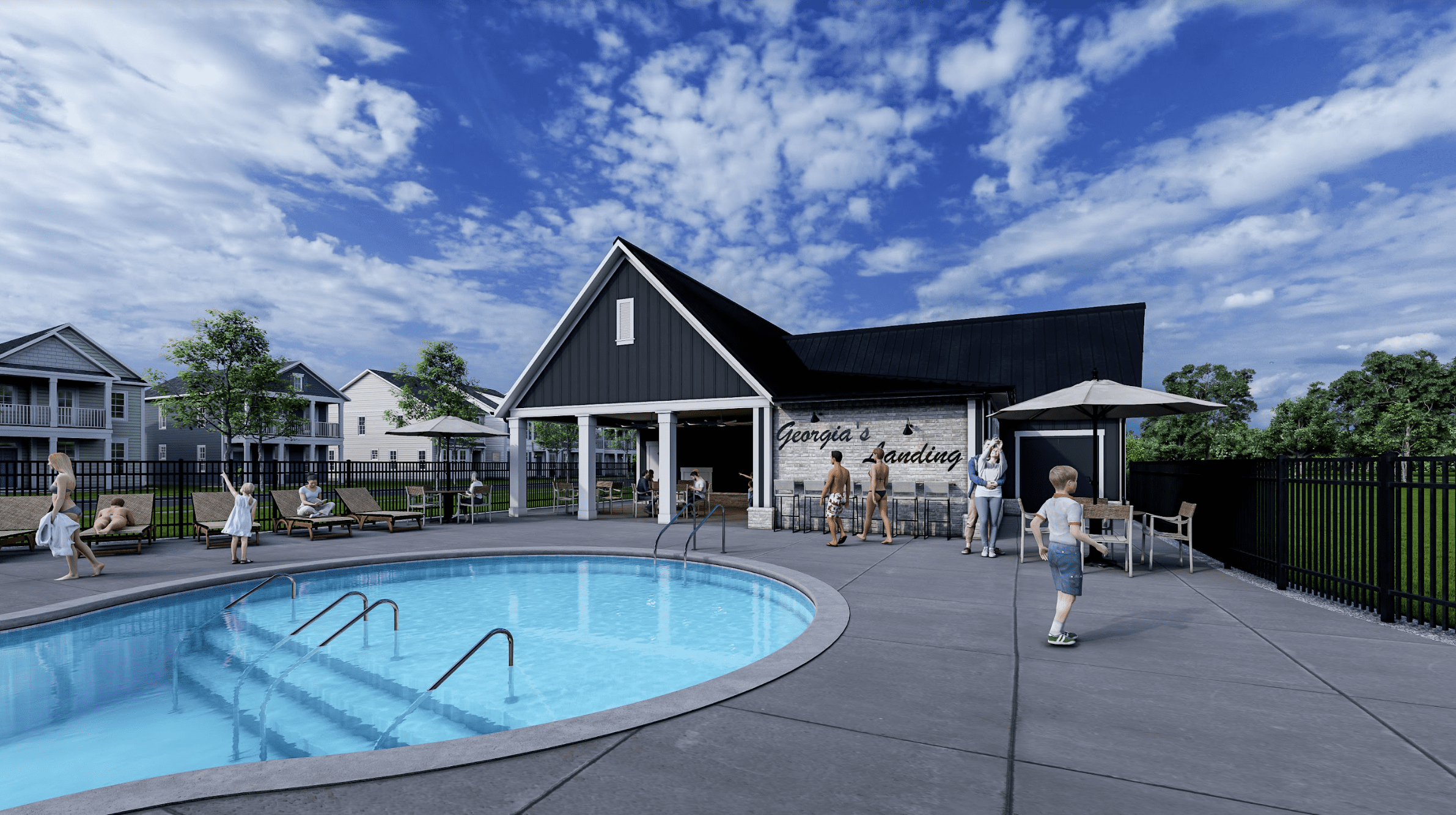

The community will include a resort-style pool, a clubhouse, a playground, a dog park and an outdoor fitness area. Project sponso Hudson Capital Properties anticipates the resort-style amenities will give the Hudson at Georgia’s Landing a competitive advantage over other multifamily housing in the area, which has seen substantial population and economic growth in recent years.

Metropolitan Raleigh has become one of the fastest-growing and most attractive areas in the country. Over the past five years, its population has grown 14.2% — more than triple the national average. Urban Land Institute recently ranked Raleigh No. 6 on its Overall Real Estate Prospects 2023 list. U.S. News & World Report recently ranked Raleigh sixth on its list of the Best Places to Live 2022. Economic and population growth, combined with an affordable cost of living, will increase the demand for multifamily housing in the Raleigh metro, helping Hudson Capital secure and maintain high occupancy rates.

An added benefit for investors comes in the form of qualified opportunity zone tax advantages. The tax benefits offered through the program include deferred capital gains until Dec. 31, 2026, and the potential elimination of taxes on new capital gains if the investment is held for at least 10 years.

Hudson Capital Properties, a real estate investment and development firm founded in 2009, has been involved in more than $2.5 billion in real estate transactions. The New York-based group, with a satellite office in Raleigh, will be coinvesting 44% of the required equity alongside investors, demonstrating its commitment and confidence in the development. Hudson manages real estate valued at nearly $390 million.

The Sponsor

Hudson Capital Properties is committed to investing in and operating quality workforce housing and commercial real estate. It is our goal to elevate the economic and social fabric of communities through development and asset repositioning.

Since 2009, we have built an experienced team that is dedicated to growing our business and growing our investors’ capital through diligent acquisition, thoughtful development and a hands-on asset management approach. With a track record reflecting more than $2B+ in transactions, the success of the portfolio is a result of strong relationships across the industry and an entrepreneurial ethos.

See Company Bio

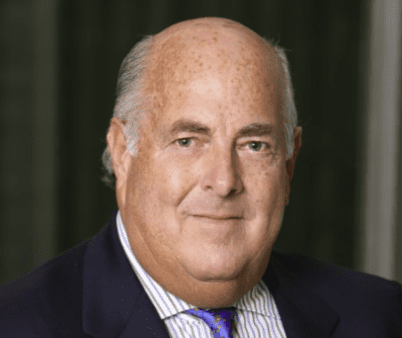

James S. Cohen - Chief Executive Officer & Chairman

- James founded Hudson Capital Properties in 2009 and has served as the CEO and Chairman ever since. With an eye for strategic planning, James is the final gatekeeper on all transactions, acquisitions, and dispositions.

- In addition to his work with Hudson Capital Properties, James has an extensive and meaningful track record in the media and distribution industry having joined the family company Hudson Media in 1980, and served as the President and CEO since 1994.

Robert B. Cohen II - Chief Investment Officer & President

- Robert joined Hudson Capital Properties in 2014 and as the Chief Investment Officer and President, he is involved in all aspects of the business with an emphasis on transactions, capital markets, and business development.

- Robert focuses on maximizing value creation for Hudson and its investors by employing a personal approach to understanding the individual needs of every asset.

Philip H. Meisner - General Counsel

- Phil joined Hudson in 2012 and is the executive team’s key advisor on strategic and tactical legal aspects of the business. This includes the company’s financing, business structures, agreements and general business contracts.

- Phil is also responsible for the legal aspect of all business transactions surrounding Hudson’s real estate financing, acquisitions and dispositions, and maintaining Hudson’s overall operations in accordance with best practices.

Edward B. Vinson - Managing Director

- Edward joined Hudson Capital Properties in 2015 and is a key member of the firm’s leadership team. His primary focus with Hudson is asset management and development.

- Having managed and developed real estate both in the U.S. and internationally for over 30 years, Edward has gained a deep understanding of the inner workings of the industry.

Mathias G. Linden – Managing Director

- Mathias joined Hudson Capital Properties in 2015 and has played an instrumental role in its expansion into an institutional platform. As a core member of the firm’s leadership team, Mathias focuses on capital markets and new business opportunities. He also has extensive experience in development and distressed debt.

Offering Summary Details

- 44%+ co-invest ($9.5M) exemplifies tenured Sponsor’s confidence in the project that can be closely managed by their local Raleigh office. Since 2009, Hudson Capital Properties, based out of New York, has been involved in more than $2B in real estate transactions.

- Raleigh-Durham, #6 Overall Real Estate Prospect 2023 – Urban Land Institute, is experiencing tremendous population and rent growth following the prominent corporate expansion into the area looking to take advantage of lower cost of business and living as well as a highly educated workforce. Companies like Apple, Google, Fidelity, MetLife, Gilead, Lilly, Amgen, Amazon and many others continue to expand in and around Raleigh due to the combination of proximity to the Research Triangle Park and three tier-1 universities (Duke, UNC, NC State) that produce large talent pools of young professionals each year.

- Located just south of Downtown Raleigh, residents will enjoy close proximity to employment nodes and convenient access to all that Raleigh has to offer. Situated along US-401, the Project provides convenient access to the city’s highway system and allows residents to easily commute to key employment or entertainment nodes like the Research Triangle Park, Morrisville, Cary, and Downtown Raleigh. The Property is located a few minutes south of the $2.2B master-planned development of Downtown South. Plans detail that approximately 135 acres of land will be developed into a whole new district including around 3M SF of office space, 225k+ SF of retail, 3k+ of apartment units, and 750k+ hotel keys.

- Project construction led by Berkshire Hathaway-backed General Contractor and property will be managed by North Carolina-based property management company. The Sponsor has purchased the land from one of the premier homebuilders in the Carolinas/Mid-Atlantic, and they will remain as GC to ensure cohesiveness of the master-planned community. The project will also benefit from the contractor’s balance sheet and buying power as one of the largest homebuilders in the country. Bell Partners, based out of Greensboro, NC, will be the property manager and currently works with the Sponsor on other portfolio assets.

- Highly desirable build-to-rent (BTR) asset type with top-of-market amenities integrated within larger master-planned community. One significant benefit of being part of the master-planned community at Georgia’s Landing is that the larger scale supports superior amenities than what would typically be offered at a traditional multifamily building creating a competitive advantage for this project. See Property section for more details on amenities.

- Sponsor cost backstop will provide protection from unexpected cost fluctuations associated with construction materials/labor. Sponsor will cover any unexpected cost overruns with respect to initial construction through an internal loan at a preferred return rate.

- Advantageous tax benefits for investors available through Opportunity Zone designation. This project resides in a designated Opportunity Zone that allows investors to defer taxes due on capital gains and – in certain cases – elimination of taxes on new capital gains from returns generated by the investment. See Business Plan for more details

- The site is shovel-ready representing reduced pre-development risk to investors. All infrastructure has been completed, roads have been paved, and vertical construction is ready to commence.

- Total project returns are expected to take 4-6 years as three phases of development are completed.

- Cash distributions will be heavier on the back end than upfront, as the building become occupied then there will be more distributions.

- Offers can be accepted on a rolling basis.

- A waterfall structure can be provided upon request.

- The total capital ask is 12M with a minimum investment of 1.5M.

- Limited Partner is anticipated to be to be 15.7%. Distributions will be given quarterly for the preferred return of 7.5%.

- The waterfall structure will start at 80/20 up until the IRR threshold of 15%. After 15% IRR the split will be 70/30, and anything above 20% will be at 60/40.

- The preferred return will begin at closing, and the expected project completion will be approximately 4-6 years from closing.

- Cash-on-cash returns are expected to be around 7%.

- Minimum Investment will be 1.5M.

The Property

- Type: BTR single-family

- Year To Be Completed: 2024

- Number of Buildings: 28

- Number of Stories: 2/3

- Acres: 37.5 acres

- Net Rentable Area: 259,261 SF

- Number of Units: 138

- Average Unit SF: 1,879

- Parking Spots | Ratio: Tenants will have the use of their private garage and driveway as their designated parking. Just counting the garages there are 271 parking spaces.

- Address: 6004 Fayetteville Road, Garner, NC 27529

- Buildings: 28 buildings ranging of 4 to 7 units

- Stories: The 138 units consists of 95 2-story/2-car garage units, 38 3-story/2-car garage units, and 5 2-story/1-car garage units.

- Parking Spaces: The tenant will have the use of the garage and driveway as their designated parking. Just counting the garages there are 271 parking spaces.

- Parking Ratio: Approximately 2 per unit

- Year Constructed: 2023 and 2024

- Exterior:

- General Construction: Wood frame, brick, stone veneer, and concrete siding

- Foundation/Footings: Monolithic slabs

- Exterior Wall Finish: Wood studs, brick and stone veneer, and concrete siding

- Windows: Double hung

- Entrance Doors: 2 panel fiberglass

- Roof: 3-Tab 25 Year

- Gutters: Full House will have standard gutters.

- Patios/Porches: Varies per plan 3’ by 3’ to 10’ by 3’

- Landscaping consists of the following groups:

- Sod – 80% sod (up to 15 pallets) and 20% pinestraw

- Shrubs – 10 3-gallon and 2 7-gallon plants

- Trees – 2 30-gallon/MB and WL 1 30-gallon (May deviate per lot/corners)

- Interior:

- HVAC: 14 SEER Electric Heat Pump

- Plumbing: 40-gallon tank water heater, Delta faucets, and fiberglass tubs/showers

- Electrical: White flush mount fixtures in common areas and chrome vanity lights, and LED Disc lighting in Kitchen, bedrooms, pantry, halls, baths, and storage

- Stairs: Carpet Box

- Garage: Garage Door Opener

- Shelving: Ventilated wire

- Bath Accessories: Chrome fixtures

Unit Mix

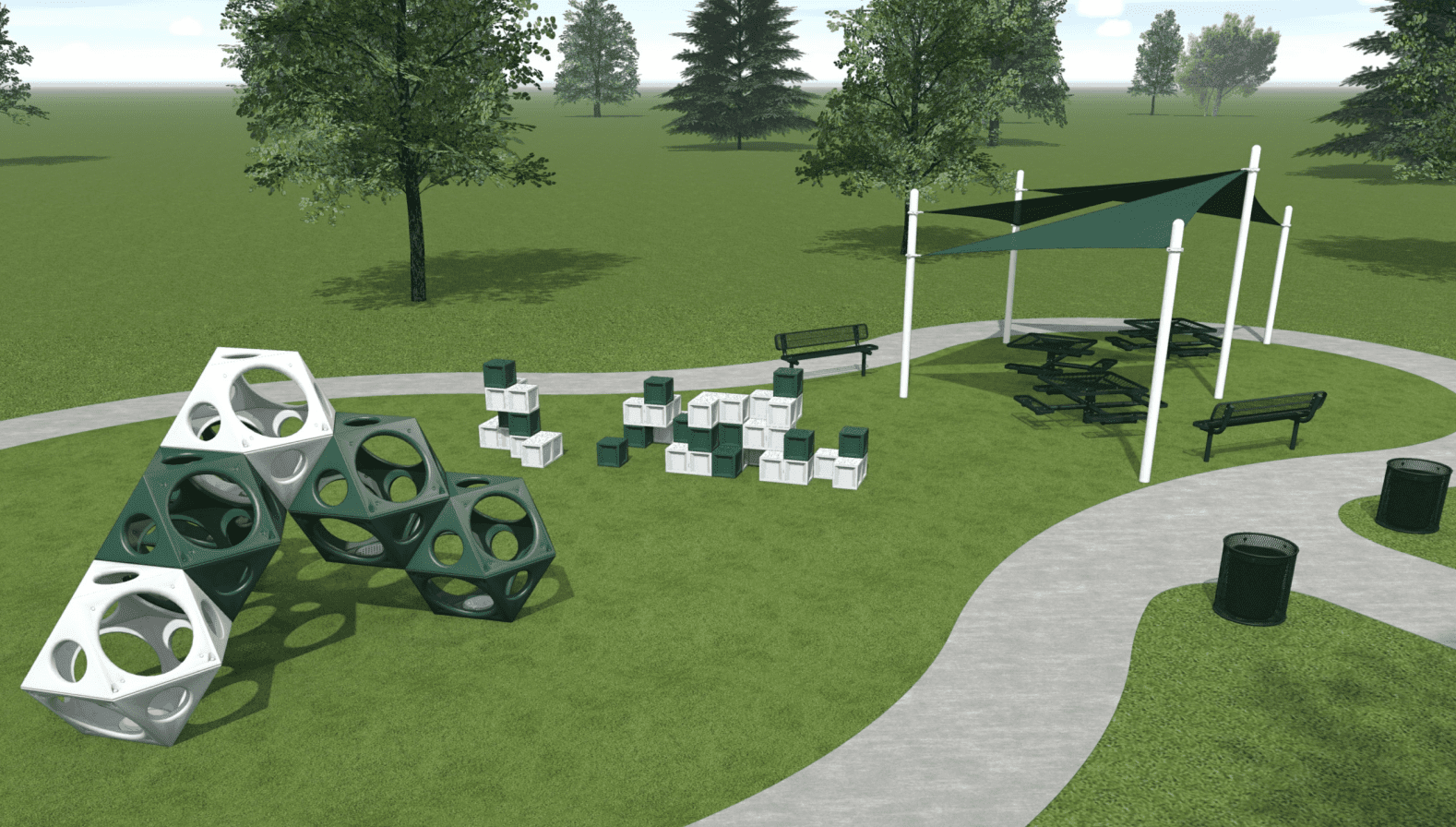

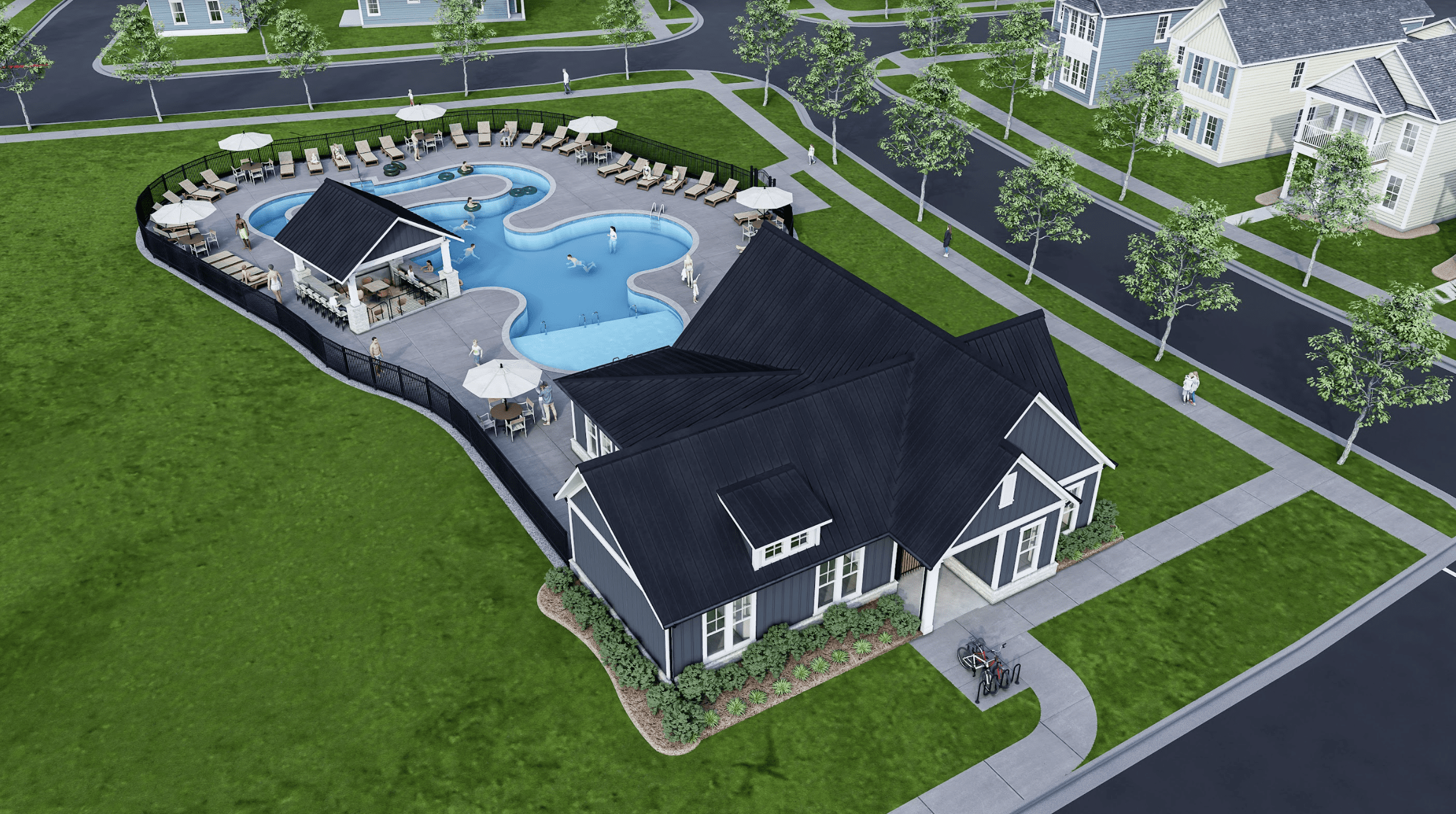

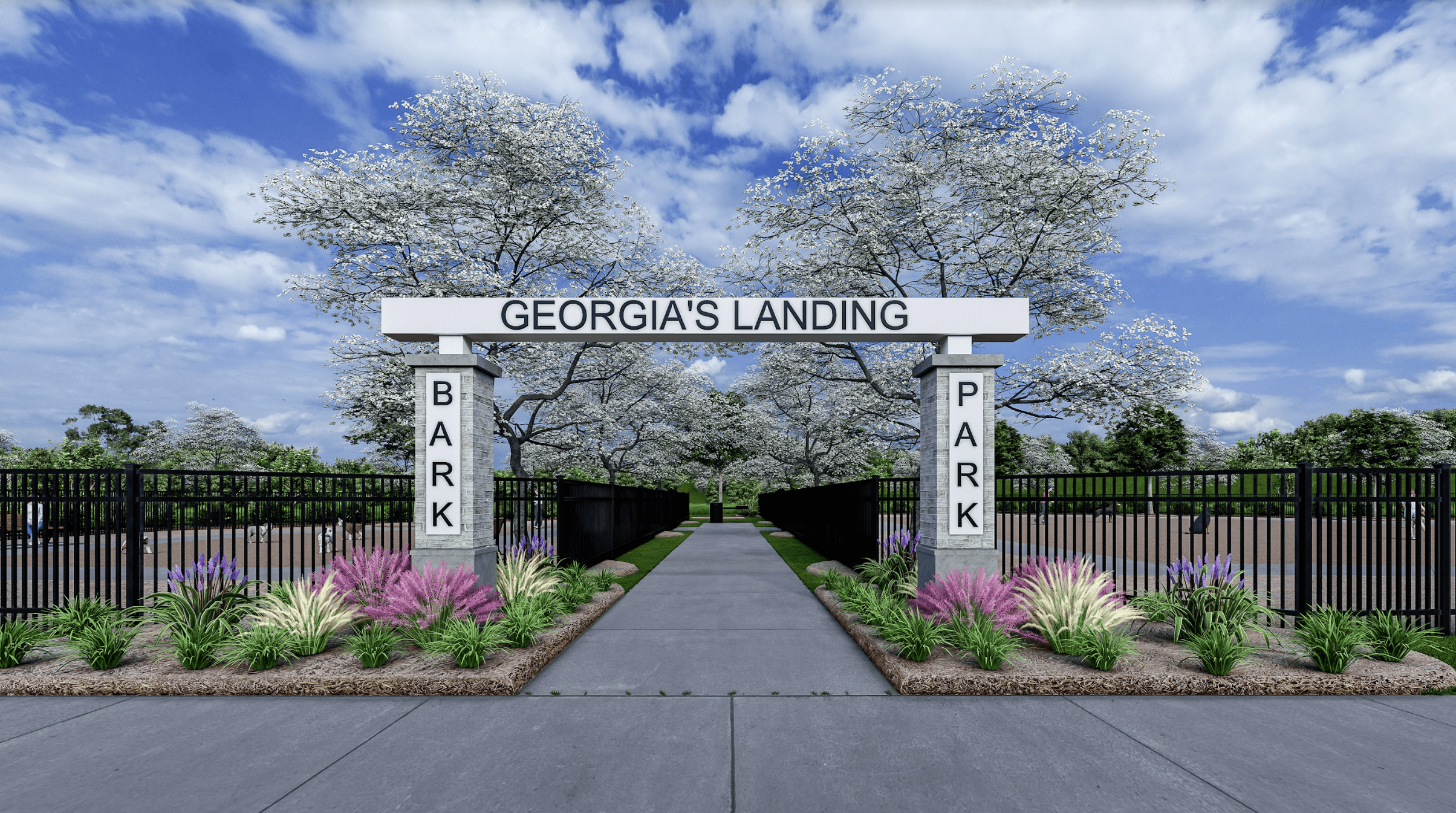

Amenities

Community Amenities:

Residents of Hudson at Georgia’s Landing will enjoy an array of amenities that will be spread across the site. The pool area will be located by the clubhouse on the north-end of the townhome section of the neighborhood and will feature a sunken cabana with swim-up built-in pool seating, a tanning ledge, and a lazy river. In addition, throughout the community are a collection of five mini parks which will contain a dog park, an additional playground, an outdoor fitness pod, a collection of play equipment, and one use still to be determined. The neighborhood will also feature a trail system.

Unit Amenities:

All units will gave 9-foot ceilings on first floors and 9-foot ceilings on second floors of three-story plans, granite countertops in the kitchens, luxury vinyl plank flooring throughout, garage doors with decorative hardware and automatic openers, stainless steel kitchen appliances including electric range, microwave, and refrigerator, washer/dryer, white cabinets with crown molding, ceiling fans in all bedrooms and great rooms, faux wood 2” blinds on all windows, outdoor living areas sized per plan, and fully landscaped lawns.

Offering Summary

Investor Details

| LP IRR: | 15.7% |

| LP Equity Multiple: | 1.89x |

| Cash-on-Cash Returns: | 6.95% |

| Preferred Return: | 7.5% |

| Preferred Return Accrual Date: | Closing |

| Hold Period: | 4-6 yrs. |

| Capital Ask: | $12,000,000 |

| Minimum Investment: | $1,500,000 |

| Waterfall Structure: | 80/20 |

| Offers Due: | Rolling Basis |

Project Returns

| Project IRR: | 19.5% |

| Project Equity Multiple: | 2.15x |

| Cash-on-Cash Returns: | 8.7% |

| Total Ticket Size: | $52,500,000 |

| DSCR: | 1.35x |

| Debt Yield: | 12% |

Sponsor

| Name: | Hudson Landing Group |

| Web URL: | Visit Website |

| Current AUM: | 65M |

| Closed AUM: | 125M |

| Years In Business: | 8 |

| Historical IRR: | 18.56% |

| Historical Equity Multiple: | 2.05x |

| Historical Cash-on-Cash Returns: | 9.78% |

Asset Details

7760 Midtown Market Ave Bldg C, Raleigh, NC 27616, United States

| Unit/Key Count: | 158 |

| Purchase/Development Price: | $52,500,000 |

| Site Size: | 20 acres |

| Property Type: | Build to Rent |

| Investment Profile: | Development |

| City/State: | Raleigh, NC |